The global memory market is tightening into a supply crisis, with price surges and allocation controls expected to stretch well into 2026. Driven by voracious demand for high-bandwidth memory (HBM) from artificial intelligence systems, manufacturers including Samsung Electronics Co., SK Hynix Inc. and Micron Technology Inc. are shifting production away from older-generation chips, creating severe shortages of mainstay DDR4 memory and pushing lead times toward historical extremes.

The crunch marks a structural shift from the oversupply that plagued the sector just two years ago. While inventories began thinning in late 2024, the acceleration of AI server deployments has since upended the balance. HBM—a premium, stacked memory essential for training large language models—is consuming an ever-larger share of advanced production capacity, crowding out output of conventional DRAM and NAND flash chips.

“What we’re seeing isn’t a cyclical blip—it’s a reallocation of the entire industry’s capacity toward AI,” said Wallace C. Kou, chief executive officer of controller-maker Silicon Motion Technology Corp., speaking at the Global Memory Innovation Forum in September. He warned that shortages, particularly for NAND, will intensify through next year.

Demand: AI Everywhere

The appetite comes from all corners of computing. Data centers are scrambling for HBM and high-speed DDR5 to feed GPU clusters, while also stockpiling enterprise solid-state drives to store massive training datasets. In AI PCs and smartphones, larger, faster memory has become non-negotiable for on-device inference, pushing flagship handsets to 16 gigabytes of LPDRAM and 512-gigabyte storage as a baseline. Emerging wearables like AI glasses are adding another layer of sustained, if niche, demand.

Supply: The Great Squeeze

In response, chipmakers are executing a historic pivot. Samsung, SK Hynix and Micron are systematically repurposing production lines toward HBM and DDR5, leaving fewer wafers for legacy DDR4. Industry analysts estimate the resulting gap for mature DRAM could reach 15–20% in 2025. Expanding HBM output is itself a bottleneck—the process involves complex through-silicon vias and advanced packaging—limiting how quickly supply can respond.

The discipline extends to NAND flash, where manufacturers have resisted the temptation to aggressively add bit capacity. Meanwhile, a parallel shortage in nearline hard disk drives—a legacy of years of underinvestment—is forcing cloud providers to shift more data onto enterprise SSDs, tightening the high-end NAND market further.

Price Spike and Allocation Anxiety

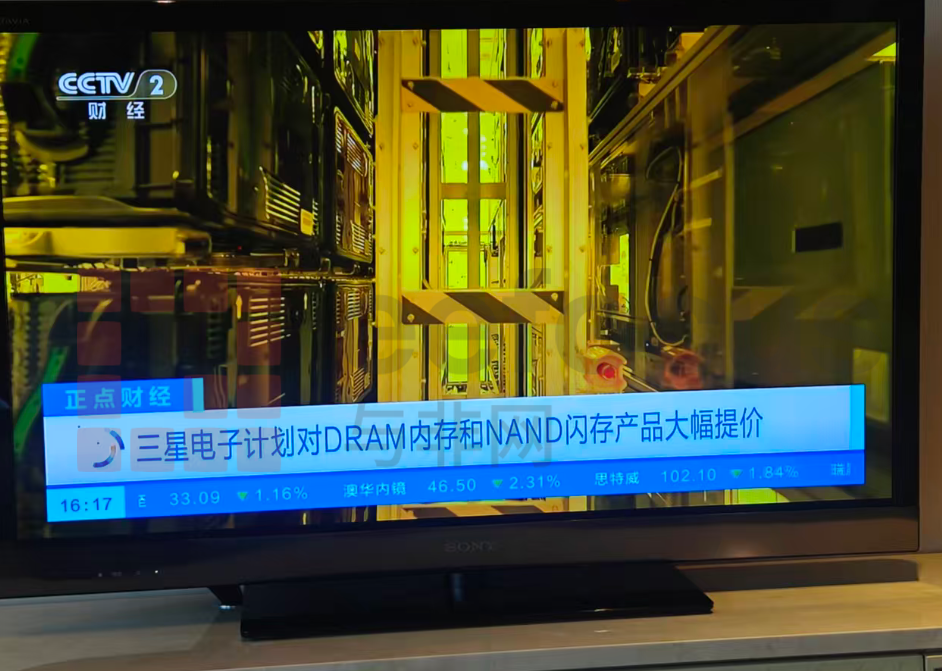

The signals are flashing red across the supply chain. In September, module makers ADATA Technology Co. and Team Group Inc. suspended price quotations—a move not seen since the 2017‑18 shortage—citing insufficient supply from chipmakers. Samsung has notified customers of plans to raise DRAM and NAND prices by 15–20% in the fourth quarter, while Micron has floated increases of 20–30% for certain DRAM products.

Spot prices are already running hot. In a striking inversion, some DDR4 chips now trade above their DDR5 equivalents, a testament to the severity of the capacity withdrawal. For server DDR4 modules, spot prices in China have reportedly tripled since mid-year. Lead times, which had normalized to several weeks, are stretching back toward double‑digit weeks, with analysts warning that 50‑week delays—last seen during the pandemic—could return for critical components.

The 2026 Outlook: Tightness as the New Normal

Forecasts suggest the imbalance will persist. TrendForce projects DRAM contract prices to rise 13–18% in the fourth quarter, following a 15–20% jump in the third quarter. For 2025, DRAM revenue is on track to grow about 51% to $136.5 billion, after a 75% surge in 2024.

The question is no longer whether the market will tighten, but for how long. Each link in the chain—from chipmakers to module suppliers to device manufacturers—is now recalibrating strategies around scarcity. Chipmakers are prioritizing long-term contracts with key hyperscalers; module firms are rationing shipments by customer tier; and OEMs are scrambling to secure supply, often redesigning products to accept multiple memory sources.

For China, the shortage presents both risk and opportunity. Domestic champions Yangtze Memory Technologies Co. and ChangXin Memory Technologies Inc. are gaining share in the local market, but they remain unable to fully offset the global shortfall in mature-node chips.

Bottom Line

The memory industry is in the grip of an AI‑powered super‑cycle—one defined not by a broad‑based demand boom, but by a dramatic reallocation of finite silicon. With HBM capacity locked up through 2025 and chipmakers steadfast in their capital discipline, the era of cheap, abundant memory is over. For buyers, the imperative has shifted from hunting for discounts to securing enough supply to keep production lines running. In this new landscape, supply chain resilience—not just price—will separate the winners from the stalled.